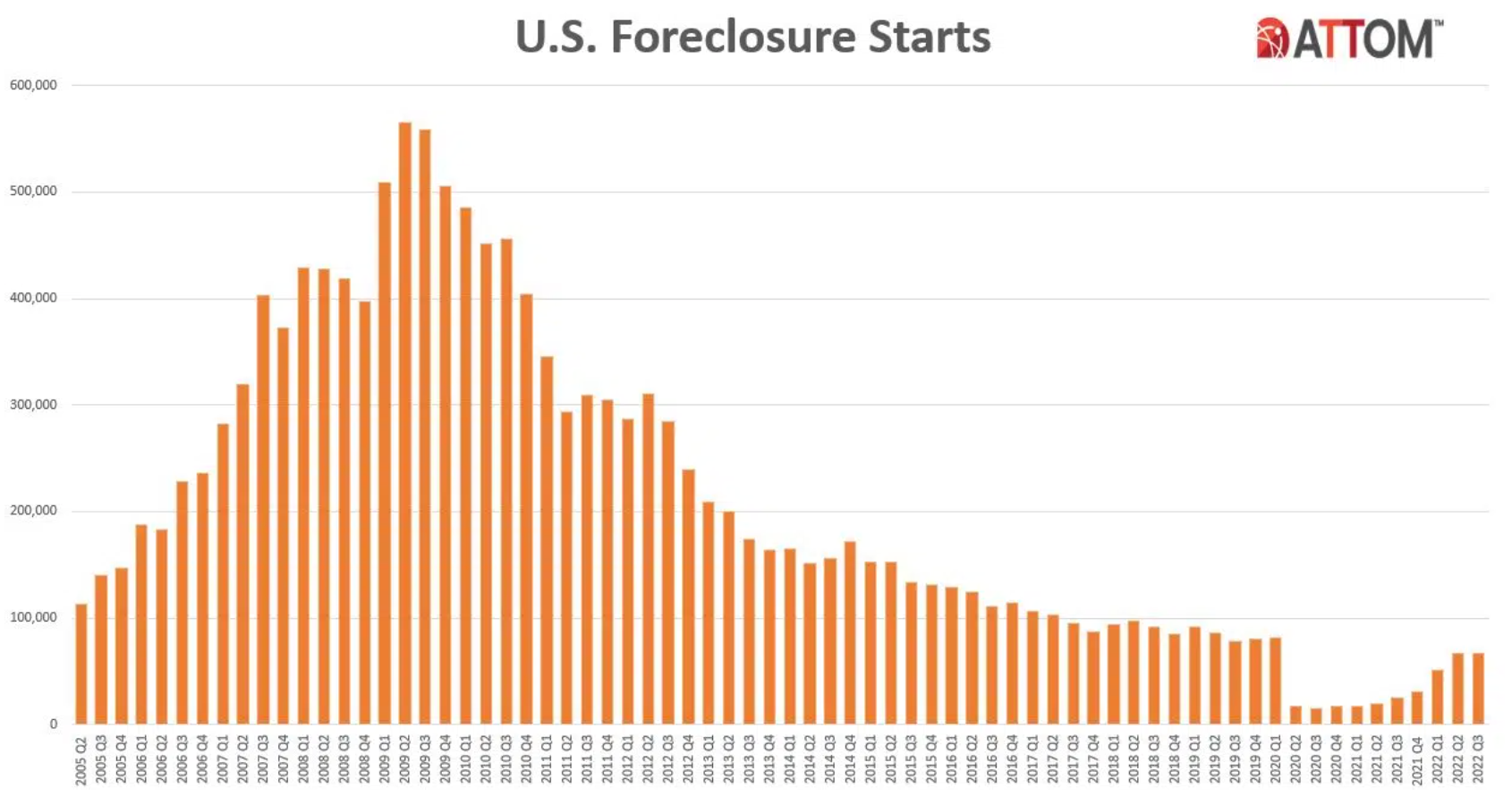

3X Amount of Homes were Foreclosed in 2019 than in 2022

U.S. Foreclosure Starts, Image courtesy of ATTOM Data Solutions

October 14, 2022

By R. Michael Brown, Go Home TV Producer

ATTOM* Data Solutions reported nationwide there were 92,634 distress properties in the 3rd quarter of 2022, increased 3.0% from the 2nd quarter of 2022, and rose 104.0% from the 3rd quarter of 2021; while one in every 1,517 properties had foreclosure in the 3rd quarter of 2022.

"Foreclosure starts, while rising since the end of the government's foreclosure moratorium, still lag behind pre-pandemic levels," said Rick Sharga, executive vice president of market intelligence for ATTOM said in a news release. "Foreclosure activity is reflecting other aspects of the economy, as unemployment rates continue to be historically low, and mortgage delinquency rates are lower than they were before the COVID-19 outbreak."

States that posted the greatest number of foreclosure starts in Q3 2022, included California (7,368 foreclosure starts); Florida (6,671 foreclosure starts); Texas (6,217 foreclosure starts); Illinois (4,702 foreclosure starts); and New York (3,997 foreclosure starts).

Nationwide one in every 1,517 properties had a foreclosure filing in Q3 2022. States with the highest foreclosure rates in Q3 2022 were Illinois (one in every 694 housing units with a foreclosure filing); Delaware (one in every 825); New Jersey (one in every 855); South Carolina (one in every 971); and Ohio (one in every 1,027).

Lenders started the foreclosure process on 67,249 U.S. properties in Q3 2022, up 1 percent from the previous quarter and up 167 percent from a year ago - nearly reaching pre-pandemic levels.

Lenders repossessed 10,515 U.S. properties through foreclosure (REO) in Q3 2022, up 18 percent from the previous quarter and up 39 percent from a year ago.

"Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure," Sharga noted. "In fact, nearly three times more homes were repossessed by lenders in the second quarter of 2019 than in the second quarter of 2022. We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction."

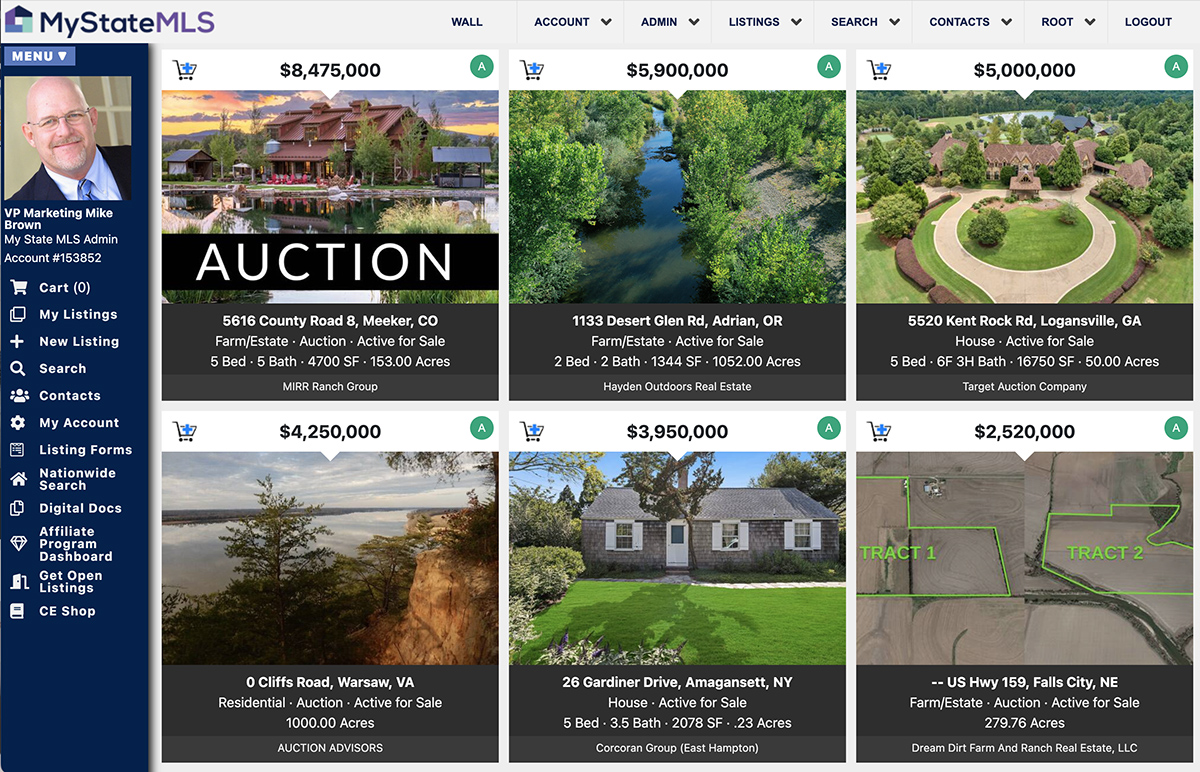

See Auction Listings on My State MLS. There are currently 15,489 auction listings on MyStateMLS.com. To find them, My State MLS Members go to your Dashboard (Wall), go to Search MLS Listings from the Search dropdown. Enter "Auction" in the Keywords field. You can also search "Foreclosure" in the Keywords field. You must be a My State MLS or NY State MLS member to get access to this feature.

MyStateMLS.com Member Dashboard, Search for "Auction" in the Listing Database

"We expect foreclosure starts to rise, however in the short term, most should be able to sell and still have equity or at least be even," said Dawn Pfaff, President of My State MLS. "However longer term, homeowners who bought at the height will most likely be under water and will have to let the home go to auction. It's very important to price the property right to sell quickly in a down market if you can't make your payments. This way, you cut your losses and can still walk away with some cash."

September 2022 Foreclosure Activity High-Level Takeaways

- Nationwide in September 2022 one in every 4,413 properties had a foreclosure filing.

- States with the highest foreclosure rates in September 2022 were Illinois (one in every 1,959 housing units with a foreclosure filing); Nevada (one in every 2,473 housing units); New Jersey (one in every 2,649 housing units); Maryland (one in every 2,825 housing units); and Ohio (one in every 2,885 housing units).

- 21,869 U.S. properties started the foreclosure process in September 2022, down 9 percent from the previous month but up 113 percent from a year ago.

- Lenders completed the foreclosure process on 3,509 U.S. properties in September 2022, down 11 percent from the previous month but up 31 percent from a year ago.

* ATTOM, a leading curator of real estate data nationwide for land and property data