International Buyers Shot Up 8.5% to $59 Billion in Sales

Getty Images

July 21, 2022

By R. Michael Brown, Go Home TV Producer

A report released this week by the National Association of Realtors (NAR) showed that international buyers purchased $59 billion worth of U.S. residential properties from April 2021-March 2022, up 8.5% from the previous year and breaking a three-year streak of declines. The 98,600 existing homes sold - the lowest since NAR tracking began in 2009 - were down 7.9% from the previous year. In terms of overall dollar volume, rising foreign buyer purchase prices offset the annual decline in homes sold.

"Property in the US is seen as a safe investment for international buyers who are looking to protect their assets," said Dawn Pfaff, President of My State MLS. "Even if there is a recession here, the United States is still a safe haven because of property rights protections."

"For the second year in a row, restrictions and general caution tied to international travel during the pandemic slowed home buying by wealthier foreign buyers," said NAR Chief Economist Lawrence Yun. "Even so, domestic home buying demand was exceptional and, therefore, boosted home sales nationally."

NAR's 2022 Profile of International Transactions in U.S. Residential Real Estate surveyed members about transactions with international clients who purchased and sold U.S. residential property from April 2021 through March 2022. Foreign buyers who resided in the U.S. as recent immigrants or who were holding visas that allowed them to live in the U.S. purchased $34.1 billion worth of U.S. existing homes, a 5.2% increase from the prior year and representing 58% of the dollar volume of purchases. Foreign buyers who lived abroad purchased $24.9 billion worth of existing homes, up 13.2% from the 12 months prior and accounting for 42% of the dollar volume. International buyers accounted for 2.6% of the $2.3 trillion in existing-home sales during that time period.

The average ($598,200) and median ($366,100) existing-home sales prices among international buyers were the highest ever recorded by NAR - and 17.7% and 4.1% higher, respectively, than the previous year. The increase in foreign buyer prices partly reflects the increase in U.S. home prices, as the monthly average existing-home sales price rose to $374,300, up 10% from the prior period. At just over $1 million, Chinese buyers had the highest average purchase price, and nearly a third - 31% - purchased property in California.

"Affordability challenges along with the inability to find the right property were the top reasons given for prospective international buyers who showed interest but ultimately did not purchase a home in the United States," said Yun.China and Canada remained first and second in U.S. residential sales dollar volume at $6.1 billion and $5.5 billion, respectively, continuing a trend going back to 2013. India ($3.6 billion), Mexico ($2.9 billion), and Brazil ($1.6 billion) rounded out the top five.

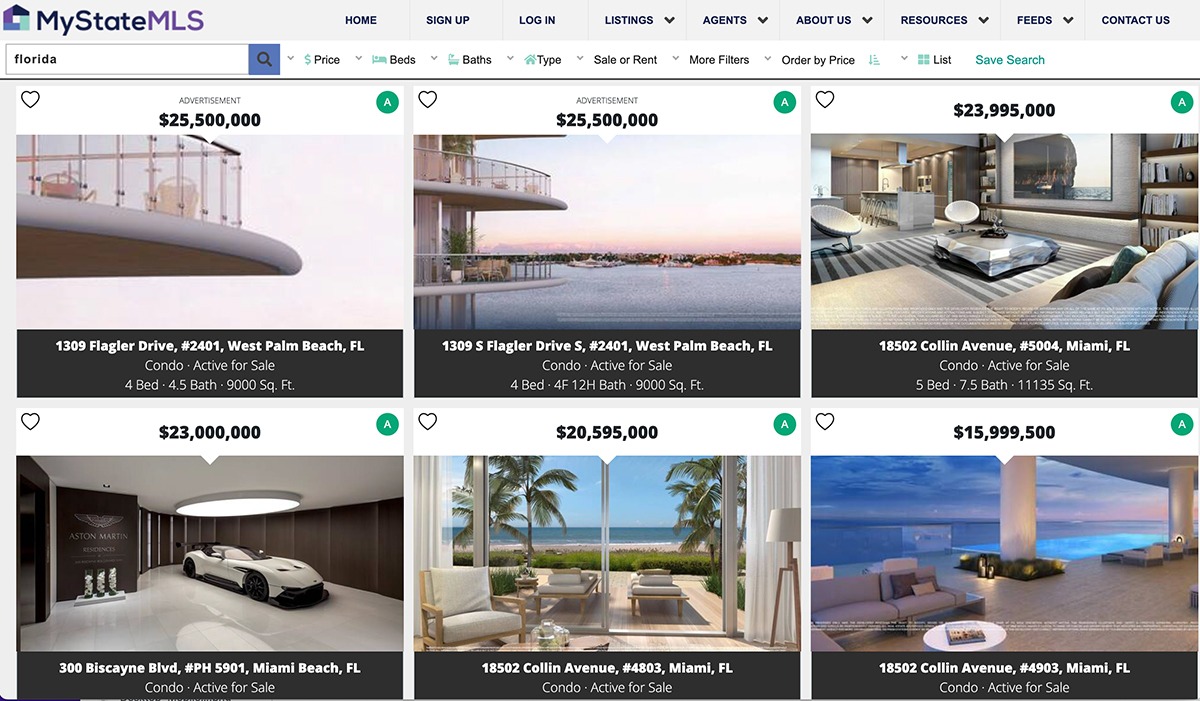

For the 14th straight year, Florida remained the top destination for foreign buyers, accounting for 24% of all international purchases. California ranked second (11%), followed by Texas (8%), Arizona (7%), and New York and North Carolina, tied at 4%.

All-cash sales accounted for 44% of international buyer transactions, nearly twice the rate (24%) of all existing-home buyers. Non-resident foreign buyers (60%) were twice as likely to make an all-cash purchase compared to resident foreign buyers (30%). Nearly 7 out of 10 Canadian buyers (69%) made all-cash purchases, the highest share among foreign buyers. Asian Indian buyers were the least likely to pay all-cash, at just 9%. Almost 6 out of 10 Chinese buyers (58%) and a quarter of Mexican (27%) and Brazilian buyers (26%) made all-cash purchases.

"Due to rising interest rates, overall home sales will decline in the U.S. this year. Foreign buyers, however, are likely to step up purchases, as those making all-cash offers will be immune from changes in interest rates," Yun added. "In addition, international flights have increased in recent months with the lifting of pandemic-related travel restrictions."

"Even when the U.S. is in a recession, not every part of the world is in a recession," said Pfaff. "And those buyers often take advantage of prices that are flat or dropping here in the U.S. We expect international buyers to follow this pattern in the near term. It's why we syndicate our listings on My State MLS to dozens of international sites, all in the native language of those countries. That helps our members broaden their reach and market their listings overseas."

Forty-four percent of international buyers purchased their property for use as a vacation home, rental property or both. Approximately two-thirds of international buyers (64%) purchased detached single-family homes and townhouses. Nearly half of international buyers (46%) purchased a home in the suburbs while 29% bought a home in an urban area - both figures have held steady over the last five years. Five percent of foreign buyers bought property in a resort area, down from 17% in 2012.

View the full 2022 Profile of International Transactions in U.S. Residential Real Estate. [NAR]