Researchers: Rising Interest Rates Not Likely to Give Renters Relief

Getty Images

Better Supply-Demand Balance is Key to More Moderate Rents

June 29, 2022

By Paul Owers, FAU Media Relations

Crushing rent increases remain the norm across Florida and beyond, and the Federal Reserve's recent interest rate hike is unlikely to improve the landscape for cash-strapped renters, according to researchers at Florida Atlantic University and two other schools.

The Waller Weeks & Johnson Rental Index, a collaboration started this year by FAU, The University of Alabama and Florida Gulf Coast University, finds that renters are paying significantly more than expected based on historical trends in individual markets.

Metro Miami was the nation's most overvalued rental market in May for the third consecutive month, according to the index. In Miami, renters were paying a premium of 22.70 percent.

Five other Florida markets also are in the top 10:

- No. 2 Fort Myers (20.41 percent)

- No. 4 Bradenton/Sarasota (17.86 percent)

- No. 5 Tampa (17.52 percent)

- No. 7 Port St. Lucie (15.89 percent)

- No. 9 Lakeland (15.36 percent)

May's average monthly rental rate in the U.S. was $1,979 - 9.85 percent above what the researchers estimate renters should be paying based on past market trends.

Fort Myers had the nation's largest year-over-year rent increase in May at 33.10 percent, followed by Miami at 31.04 percent. The U.S. average was 15.87 percent. Rents traditionally rise by only 2 or 3 percent a year. The full rankings of 107 metros can be found here [WALLER, WEEKS AND JOHNSON RENTAL INDEX].

"Florida's rising rents only serve to exacerbate the ongoing housing crisis in the state," said Ken H. Johnson, Ph.D., an economist in FAU's College of Business. "The Fed's interest rate increase will price more people out of the housing market and keep them as renters - and as long as the demand for renting remains high, rental rates almost certainly will stay elevated as well."

The researchers use past leasing data from Zillow's Observed Rental Index to statistically model historical trends from 2014 and determine where rents should be now and compare those to existing rents. The difference between the two is the premium renters are paying. The higher the premium, the more overvalued a market is.The analysis covers the entire rental stock of homes and apartments.

Bennie Waller, Ph.D., an incoming faculty member at UA's Culverhouse College of Business, said year-over-year rent increases in Florida and across the country clearly are being driven by persistent inventory shortages in multifamily housing.

"Until we can build units faster, the nation's rental crisis will continue," he said.

But building faster is difficult, said Shelton Weeks, Ph.D., of FGCU's Lucas Institute for Real Estate Development & Finance.

"In addition to the lengthy approval process faced by apartment development projects, a primary culprit here is the resistance within many communities to new projects with higher levels of density," he said. "In order for markets to function properly and add supply where needed, it is critical for municipalities to streamline the approval process for these projects and for density to be increased to a point where the new units can be offered at reasonable rental rates."

The researchers say rent relief is possible, but it won't be immediate.

The latest figures suggest that the vast majority of the 107 markets is on pace for much smaller annual increases in the coming months, though the timing is uncertain.

Meanwhile, a large pool of seasonal homes being managed as short-term vacation rentals is likely to become traditional rentals because owners want to cash in on the strong market. In addition, many temporary Florida transplants who were working remotely may soon return home as more offices in other parts of the nation reopen.

"These two elements could come together to produce a better balance between supply and demand of rental units and give burdened renters a break," Johnson said. "But until then, renters may have to cut back on discretionary spending to make ends meet."

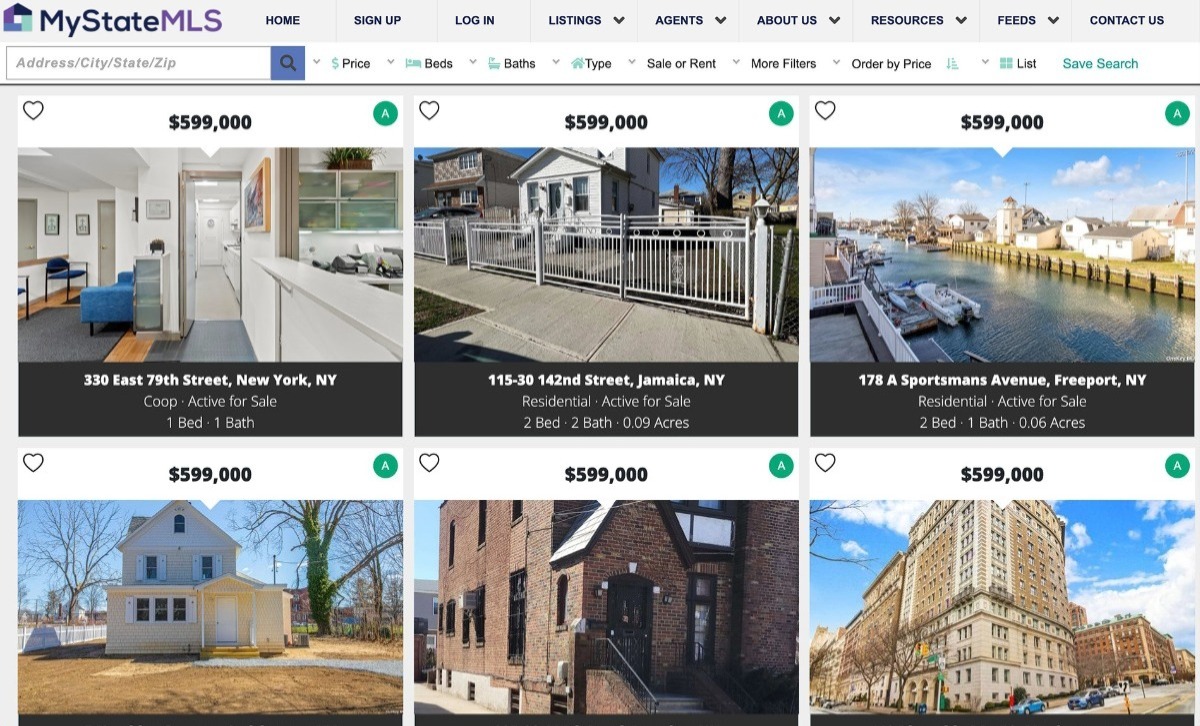

Renters and home buyers may find some relief in the My State MLS Financial Assistance - State Directory

We've created a state-by-state USA directory of federal, state, and local financial assistance programs to help residents that need information or a helping-hand to stay in the place they are living in, or find and pay for a new place to live.

Debt relief and down payment financial assistance programs are lending a hand to millions of Americans to get a residence.Whether you rent or own your current place to live, click on the state you reside in and access direct links to the financial assistance programs available in your area.

Real estate brokers and agents are welcome to use the directory to help their clients find financial assistance.